Increase the Revenues of Your Waste Company With the Tips Shared in Our Blog Articles

The Billion-Dollar Backdoor: Why Critical Raw Materials Are Reshaping the Waste Industry (And How to Profit Before the Big Dogs Do)

Let’s not waste time.

Over the last six months, the market has sent a clear message: the game has changed. And if you’re running a waste or recycling business and still thinking like a collector instead of a supplier, you're sitting on a goldmine without even digging.

Here’s the cold, hard truth: the prices of critical raw materials (CRMs) — the metals, minerals, and elements that power modern life — have gone through wild swings. Not because the earth is running out, but because politicians, manufacturers, and entire economies are in a knife fight for control.

And in that chaos? There’s opportunity.

Download the Guide “Secondary Raw Materials Opportunities”

The Price Chaos Most People Don’t See

In the last 6 months:

Lithium prices collapsed by over 70%. Oversupply? Not exactly. More like overreaction after years of hype — and the market is already swinging back.

Cobalt and nickel dropped 30–45%, not because they're obsolete, but because investors panicked.

Meanwhile, rare earth elements — the lifeblood of EV motors, defense systems, and smartphones — are being squeezed by geopolitical chokepoints.

That’s not volatility. That’s a wealth transfer in motion.

And if you’re only watching the price, you’re missing the real story: the demand didn’t drop. The demand is still climbing. It's just hidden behind reshuffled supply chains and desperate attempts by Western economies to reduce their dependency on China.

Download the Guide “Secondary Raw Materials Opportunities”

The Silent War: It’s Not Just Economics, It’s Geopolitics

Right now, China controls:

70% of the world’s cobalt refining

90% of rare earth element processing

Over 75% of natural graphite production

And in response, Europe, the U.S., Japan, and Australia are scrambling to build “independent” supply chains. But here’s the catch:

Mines don’t open overnight. Processing plants take years.

The only resource that’s already here, already on-site, and completely overlooked?

Waste.

Download the Guide “Secondary Raw Materials Opportunities”

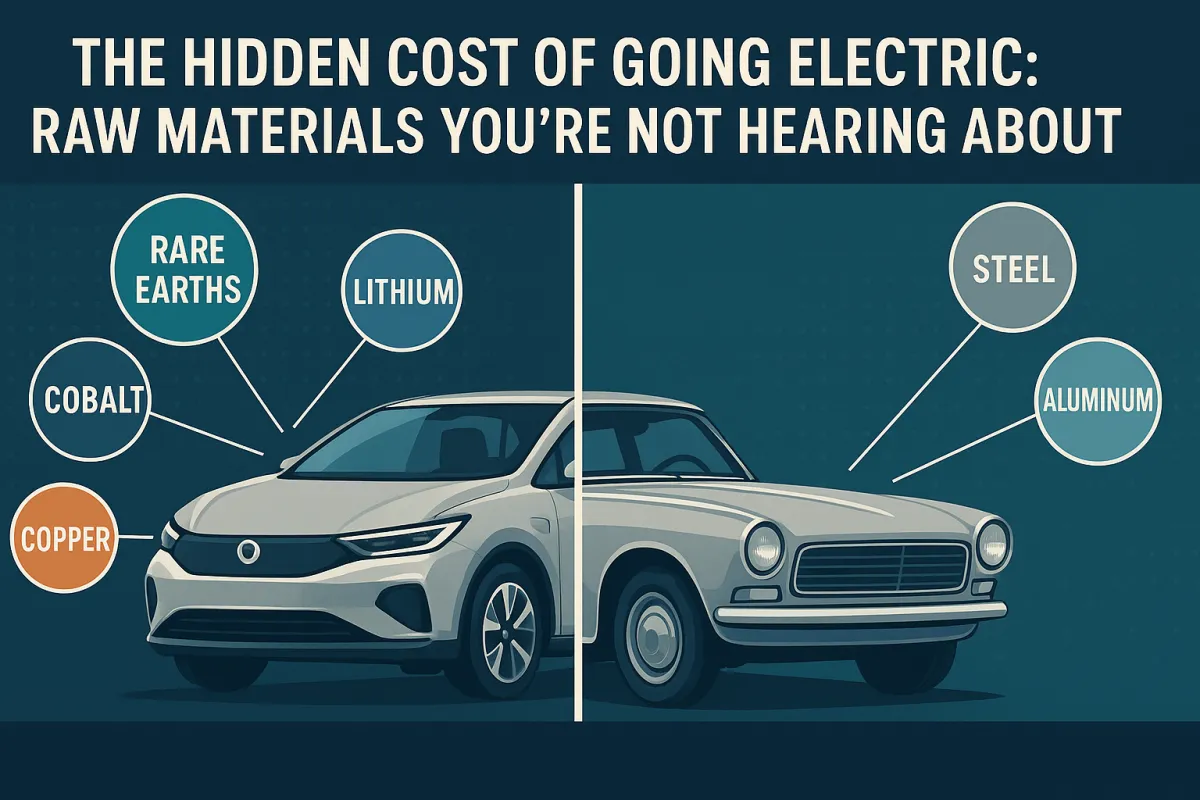

Let’s Talk Numbers: EV vs ICE and the Hidden Metal Addiction

Manufacturers don’t talk about it, but I will.

An internal combustion engine (ICE) vehicle needs about 22 kg of copper.

An electric vehicle (EV)? Over 53 kg. And that’s just copper.

Throw in:

9 kg of lithium

40 kg of nickel

13 kg of cobalt

66 kg of graphite

A cocktail of rare earths for the motor magnets

And suddenly, your “clean” vehicle is a moving mine on wheels.

Now multiply that by 15 million EVs sold globally in 2023 — and forecasted to hit 60 million per year by 2030.

It doesn’t take an economist to realize: that’s not demand, that’s a feeding frenzy.

And if you're in waste management, this is the moment when you stop calling yourself a “hauler” or “recycler” and start seeing yourself as a supplier.

Download the Guide “Secondary Raw Materials Opportunities”

The Opportunity: From Trash to Treasury

Let me be blunt.

Secondary raw materials are now on the radar of governments, automakers, and defense contractors.

But here’s the kicker — most of them have no idea how to get it. They’re stuck thinking in terms of “mines,” not landfills, scrapyards, demolition debris, e-waste, or post-industrial waste streams.

Which is why waste management companies in the U.S. are uniquely positioned to flip the script — if they shift their mindset.

Here’s what that means in practice:

1. Become a Raw Material Scout

Stop thinking in terms of “tons of waste” and start thinking in terms of grams of cobalt, copper, and rare earths per ton of collected material.

Scrap electronics, batteries, appliances, and even EVs at end-of-life are treasure troves waiting to be tapped.

💡 Smart operators are already reverse-engineering teardown values and building CRM databases based on collection streams.

2. Control the Processing — or Partner With Those Who Do

The bottleneck isn’t collection. It’s separation, purification, and certification.

You don’t need to build a full refinery. But you do need to control who you sell to, under what spec, and for what end use.

💡 The recycling facility that can deliver certified, ready-for-production cobalt or lithium will have major players knocking at their door.

3. Play the Arbitrage Game

Here’s the dirty secret nobody tells you:

💰 Prices swing wildly depending on location, purity, and access.

If you can source domestically, process strategically, and sell directly to manufacturers or battery plants — you can exploit regional shortages and export bans to your advantage.

That’s not just smart. That’s profitable.

4. Monetize the Data

In the old world, you sold tons.

In the new world, you’ll sell:

Composition data

Recovery reports

Traceability certifications

Carbon offset credits (yes, even if you don’t believe in them)

💡 A mid-sized scrap operator who owns their CRM intelligence will out-earn the big haulers still charging by the mile.

Download the Guide “Secondary Raw Materials Opportunities”

Why Now, and Not Next Year?

Because the window is open, but it won’t stay open.

Governments are launching stockpiling initiatives. Automakers are locking in long-term contracts. Defense departments are bypassing traditional suppliers and looking for secure alternatives.

If you're a waste operator and you wait until 2026 to start retrofitting your business, you’ll be too late. The majors will have already bought out the middlemen and secured exclusive flows.

The time to act is before they figure it out.

You’re Sitting on What the World Is Fighting For

Let me leave you with this:

While politicians argue over sanctions and companies rush to rewire global supply chains…

You already own what they all need.

It’s buried in your bins, mixed in your rubble, soldered into your e-waste, and stripped out of your appliances.

Your trucks are driving past millions in unrecovered critical materials — every single day.

This is not about saving the planet. This is about saving your bottom line and stepping into a supply chain role 10x more valuable than hauling ever was.

Download the Guide “Secondary Raw Materials Opportunities”

💥 Final Word (And a Challenge)

If you're serious about future-proofing your business, you need to ask one question:

"Am I going to be a waste collector… or a materials supplier?"

There is no middle ground. The transition is already happening.

If you're ready to map your CRM recovery strategy, define your waste stream value, and position your company for the next 10 years of demand, then it’s time we talk.

Download the Guide “Secondary Raw Materials Opportunities”

Let’s turn trash into treasure. Before someone else does.

To Your Success

Sam Barrili

The Waste Management Alchemist

© 2025 Marketing4waste - All Rights Reserved,

Marketing4Waste is a brand of MiM MarketingInterimManagers LLC

+1 801 804 5730